In This Article:

How does it differ to Premium Charge?

My account is losing across its lifetime. Can I qualify?

How will I be told if it impacts me?

What happens if I qualified for Premium Charge in the past?

I have built up a large Premium Charge buffer over time. Will it be lost?

I want to understand my fees and track my buffer, how do I do that?

What is commission generated and how is different to the commission I pay?

When will the Premium Charge end?

What is the Expert Fee?

Expert Fee is a contribution paid by a very small number of the most profitable customers on the Betfair Exchange. It is implemented as a weekly top-up, in addition to the standard commission, ensuring that the total fees paid by a customer equate to a specified percentage of their gross profit.

How does it differ to Premium Charge?

Expert Fee is a smarter pricing structure designed so the amount you pay reflects your performance on the Betfair Exchange right now.

Rather than just using lifetime profitability, the Expert Fee uses the gross profit from the last 52 weeks your account has been active to determine the rate that you will pay. It's a dynamic fee structure that adjusts your rate with your profitability and can return back to 0% if you don't always win at the same rate.

And what's more, it is capped at 40%. No more 50% and 60% rates.

This new approach more than halves the number of customers who generate any additional charges, lowering costs for many loyal, consistent winners.

Who qualifies for Expert Fee?

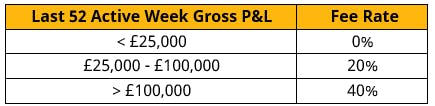

At the start of each week, Betfair will calculate the gross P&L in the last 52 weeks of your account's activity, which we call your Last 52 Active Week Gross P&L.

An account may only be considered for the Expert Fee if all of the following apply:

- Last 52 Active Week Gross P&L > £25,000

- Lifetime Gross P&L > £0

- Lifetime Markets Bet > 100

At the start of each week, we will determine your fee rate using your last 52 weeks of activity, as follows:

My account is losing across its lifetime. Can I qualify?

In order to incur the Expert Fee, your account will need to be in lifetime profit. We will still show your Expert Fee rate based on your Last 52-Week Gross P&L, but if you account is not in profit over the lifetime you will have a buffer and will not be eligible to pay the Fee.

What is an "Active Week"?

An Active Week will be considered as any week where you have at least one settled bet in a market that fully settles in that week.

How will I be told if it impacts me?

Any customer affected by the Expert Fee will be notified in advance.

Upon initial qualification, you will be sent an email notification and will have the first debit reversed back into your wallet.

What if my fee rate changes?

If you qualify for a rate higher than you have previously paid, then a further notification email will be sent out and you will become eligible for the new rate from the following week of activity.

In the first instance you qualify for the new higher rate, a grace period of one week will be given before you are moved. This will be a one-time goodwill gesture - should you move between rates in the future, then the new rate will come into effect from the following week of activity. Email communications will not be sent at this stage, but all changes will be displayed within your dashboard located in 'My Account'.

What happens if I qualified for Premium Charge in the past?

If you have previously qualified for Premium Charge but no longer meet the criteria for the Expert Fee, you will automatically be moved to the 0% rate.

If you have previously qualified for Premium Charge and do meet the criteria for the Expert Fee, you will automatically be moved onto the Expert Fee pricing structure from 6th Jan 2025. You will not receive further notification via email.

Any first week goodwill reversal and higher rate grace periods will not apply if these were availed of during the time the Premium Charge was in effect.

How do the calculations work?

If you meet the criteria for the Expert Fee, then you will be charged a proportion of your Weekly Gross P&L equivalent to the fee rate you qualify. We will subtract any commission that has been generated in the week.

And importantly, we are introducing the concept of the Buffer, which takes into consideration any losses or additional commission generated since you last paid Expert Fees, or moved to a new fee rate. The Buffer represents the gross profit that can be won before incurring further Expert Fees.

We will calculate the Buffer at the start of each activity week as follows:

The Buffer is the greater of:

(Commission Generated Since Last Expert Fee Paid / Current Expert Fee Rate) - Gross P&L Since Last Expert Fee Paid

(Commission Generated Since Last Rate Change / Current Expert Fee Rate) - Gross P&L Since Last Rate Charge

*If the buffer calculation is <£0 then we use £0.

The Expert Fee is calculated as:

Expert Fee Due = (Weekly Gross P&L - Buffer) * Current Expert Fee Rate - Weekly Commission Generated

I have built up a large Premium Charge buffer over time. Will it be lost?

In order to transition smoothly onto the Expert Fee, we will reference the last time that you incurred Premium Charge and use your activity since this point in order to calculate your new Buffer at the time that the Expert Fee takes effect on 6th Jan 2025. If you have never incurred the charge, then lifetime data will be used to calculate the Buffer.

So, if you last incurred Premium Charge in 2023, we will calculate your Buffer as:

Gross P&L Since Last Charge = £100,000

Commission Generated Since Last Charge = £60,000

Current Expert Fee Rate = 20%

New Buffer = £60,000 / 0.2 - £100,000

= £200,000

Note for a customer on the 40% rate, their Buffer would be £60,000 / 0.4 - £100,000 = £50,000

If I want to understand my fees and track my buffer, how do I do that?

As part of the introduction of the Expert Fee, we will be launching a new dashboard for those impacted to track their fees.

This will land onsite under "Expert Fee" from 13th Jan 2025 (when the new fees will be debited for the first time). Look out for the info icons to easily navigate the page and understand everything from your current fee rate to your historical performance data. We will be displaying your Buffer at the start of the week, so that you can understand how much you can profit before incurring fees again.

When do I get charged?

The Expert Fee will be deducted from customer accounts weekly (after Monday noon) in relation to the previous week's activity (Monday to Sunday).

What is commission generated and how is different to the commission I pay?

Every time a bet is placed on the Betfair Exchange, there are two customers betting on opposing outcomes. One will win and pay commission based on their specific rate, and the other pays no commission, but plays an equally important role in the bet being matched.

Commission generated recognises that the true value that a customer's activity brings to the exchange ecosystem is a combination of:

- The commission paid on winning bets

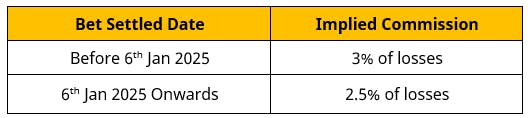

- The commission that occurs on the other side of the bet when your bet loses. We call this implied commission and we calculate this at 2.5% of all market losses, as this is the average commission rate on the exchange.

We then blend these together in the form of an average to calculate your commission generated:

- Commission Generated = (Commission Paid + Implied Commission) / 2

where Implied Commission is 2.5% of market level losses

- Implied Commission used to be 3% of market level losses. Why has that changed?

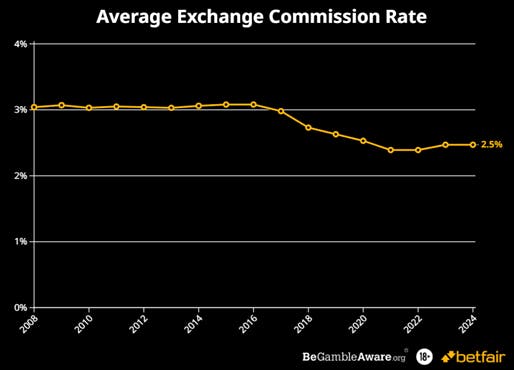

This change to the implied commission calculation reflects that the average commission rate on the Betfair Exchange has reduced over the past years and is now approximately 2.5%.

Let's take a look at how the average exchange commission rate has changed over the years:

As implied commission has been based on 3% of market losses previously, this will be retained for any historical data, but going forwards it will move to 2.5%:

When will the Premium Charge end?

The final week of activity where the Premium Charge will apply will be Mon 30th Dec 2024 – Sun 5th Jan 2025, with the final payments being taken on Weds 8th Jan 2025.

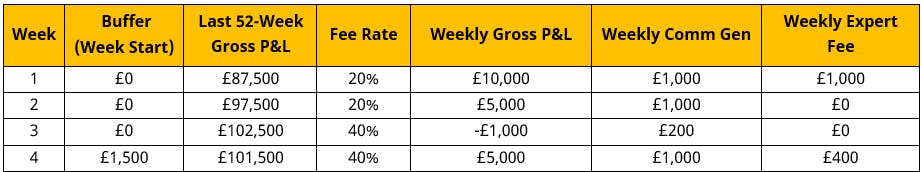

Example 1 - No Change in Rate

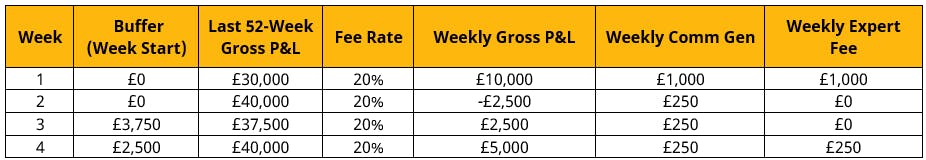

Customer A consistently qualifies for the 20% rate having maintained a rolling 52-week gross P&L of between £25k and £100k.

Below shows their activity since they last incurred a fee:

By the start of Week 3, the customer accrued a buffer of £3,750 due to losses and generating excess commission since they last incurred a fee in Week 1:

Buffer (start of Week 3) = £250 / 0.2 - (-£2,500) = £3,750

Expert Fee Due (Week 3) = (Weekly Gross P&L - Buffer) * Current Expert Fee Rate - Weekly Commission Generated

= (£2,500 - £3,750) * 0.2 - £250

= -£500

which is <£0 so no charge is due.

By the start of Week 4, the customer accrued a buffer of £2,500 having generated excess commission since they last incurred a fee in Week 1:

Buffer (Start of Week 4) = £500 / 0.2 - £0 = £2,500

This buffer is deducted from the profits of Week 4 before the Weekly Fee is calculated:

Expert Fee Due (Week 4) = (Weekly Gross P&L - Buffer) * Current Expert Fee Rate - Weekly Commission Generated

= (£5,000 - £2,500) * 0.2 - £250

= £250

Example 2 - Rate Increases

Customer B's rate increases from 20% to 40% as their rolling 52-week gross P&L increases from £25-100k to >£100k.

Below shows their activity since they last incurred a fee:

By the start of Week 4, the customer accrued a buffer of £1,500 having generated losses since they last moved fee rates in Week 3:

Buffer (Start of Week 4) = £200 / 0.4 - -£1,000 = £1,500

(The alternative buffer calculation using data since the last Expert Fee payment is:

= £1,200/0.4 - £4,000 = -£1,000 < 0 so = 0

We use the larger of the two buffer calculations which here is £1,500.)

This buffer is deducted from the profits of Week 4 before the Weekly Fee is calculated:

Expert Fee Due (Week 4) = (Weekly Gross P&L - Buffer) * Current Expert Fee Rate - Weekly Commission Generated

= (£5,000 - £1,500) * 0.4 - £1,000

= £400

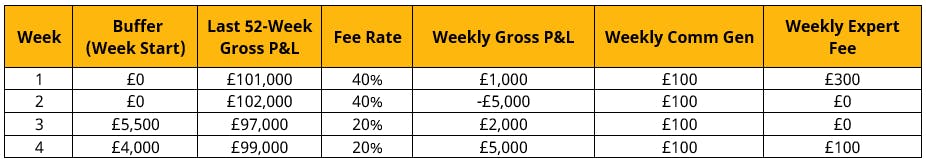

Example 3 - Rate Decreases

Customer C's rate decreases from 40% to 20% as their rolling 52-week gross P&L drops below £100k.

Below shows their activity since they last incurred a fee:

By the start of Week 3, the customer accrued a buffer of £5,500 having generated losses and excess commission since they last incurred a fee in Week 1:

Buffer (Start of Week 3) = £100 / 0.2 - (-£5,000) = £5,500

As the week start buffer is greater than the weekly profit, no fee is due.

By the start of Week 4, the customer accrued a buffer of £4,500 having generated losses and excess commission since they last incurred a fee in Week 1:

Buffer (Start of Week 4) = £200 / 0.2 - (-£3,000) = £4,000

This buffer is deducted from the profits of Week 4 before the Weekly Fee is calculated:

Expert Fee Due (Week 4) = (Weekly Gross P&L - Buffer) * Current Expert Fee Rate - Weekly Commission Generated

= (£5,000 - £4,000) * 0.2 - £100

= £100